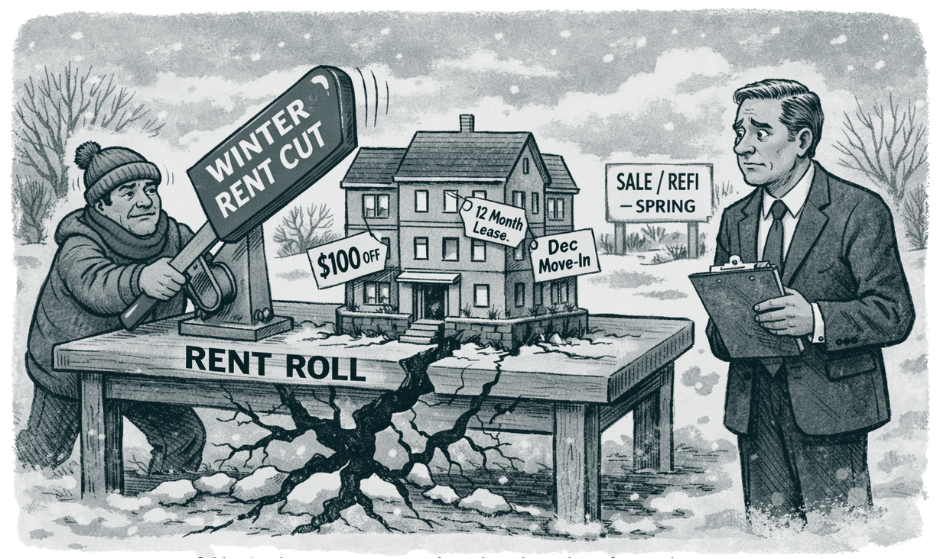

The Holiday Leasing Trap: Protect Your Rent Roll Before a Sale or Refi

Every year, late November through December turns into the rental market’s slow lane. People don’t want to tour in the dark, move in the rain, switch schools mid-year, or deal with holiday chaos. In plain terms: winter is typically the most negotiable part of the leasing calendar.

That seasonality is normal. The mistake is treating a seasonal slowdown like a permanent pricing reset.

If an owner is even thinking about a sale or refinance in the next 60–180 days, winter leasing decisions can quietly sabotage the rent roll right when it matters most.

How this shows up in underwriting

When you bring a deal to market (or to a lender), the story is built on a few simple things:

In-place rents (what’s actually on leases today)

Trailing collections / T-12 (what income has proven out)

Economic occupancy (how much vacancy/concession drag exists)

Market rent narrative (how believable the “upside” story is)

A winter rent cut doesn’t just fill a unit. It re-anchors the building’s average rent at exactly the wrong time—right before buyers and lenders start underwriting off real leases.

The blunt tradeoff: vacancy hurts, but “cheap leases” can hurt longer

Owners often react to slower winter traffic by dropping rent to “get it rented.” Sometimes that’s the right call (debt service is real). But if the owner can carry a little vacancy, they should run the math before they permanently discount the asset.

A simple example:

5 units leased $100 below target rent

Annual rent loss: 5 × $100 × 12 = $6,000/year

You get the math: at a 5.5% cap rate, that’s roughly $109,000 of value tied up in one “easy” decision

A better winter playbook: protect the contract rent and use temporary levers

If you’re advising an owner who may sell/refi soon, the goal isn’t to “go dark.” The goal is to avoid locking in a long-term, below-market rent during the slowest leasing window of the year. Especially when trying to prove out a renovation strategy.

Here are cleaner moves than cutting asking rent:

Use move-in gifts or reduced move-in costs as a "concession" instead of rent reductions (and keep them targeted)

Concessions aren’t free, but the right ones are one-time and keep the contract rent intact. In winter, aim at move-in friction instead of monthly rent:

Waive or reduce admin fees

Cover application fees (limited-time “apply free” promo)

Offer a clear move-in gift (gift card, moving truck credit, home essentials package)

Bundle add-ons for a set period (parking, storage, pet fees, WiFi)

These are easier for renters to feel immediately, and they don’t permanently reset your rent roll.

Control lease length so expirations land in peak season

If you must lease in December, consider terms that push the next decision into spring/summer (when demand is stronger). Avoid creating a bunch of December expirations that force you to repeat the same problem next year.

Improve-to-earn instead of discount-to-lease

Small upgrades that shorten days-on-market (lighting, paint touch-ups, deep clean, better photos, a simple staging pass) often beat rent cuts. Especially when prospects are browsing casually over the holidays. Don't be afraid to "over-improve" a little or provide upgrades to get through the leasing slow-season.

Run an aggressive renewal push to prevent winter vacancy

The cheapest turn is the one you don’t have. If you can convert would-be move-outs into renewals with a modest incentive, you protect occupancy and rent integrity. Add renewal incentives if you have to, including free services, appliance upgrades or one-time rent credits.

If the owner can afford it, selectively wait

Sometimes the right move is: don’t panic-lease a unit at a winter discount when you expect stronger demand 30–60 days later. This only works if cash reserves and debt service allow it.

Advisor checklist: protect the rent roll without getting cute

If an owner is exploring a sale or refinance in the near future, have them (and their PM) run this checklist before you “just lease it.”

Confirm the end goal and timeline

Is this a sale, refi, or “maybe both” plan?

What month does underwriting actually happen (not the wish date)?

What will matter most: DSCR/NOI, occupancy optics, or both?

Define the cash-flow guardrails

How much vacancy can the property carry without stress?

What’s the maximum days vacant we can tolerate per unit before we must lease?

Agree on rent-roll guardrails (owner + property manager)

Ask the owner: what’s the lowest contract rent you’re willing to accept by unit type (if any)?

Decide when “hold and wait” is acceptable vs when the unit must be leased for cash flow.

If there’s a property manager involved: make sure they’re aligned that anything below the floor (or an unusually long term) requires explicit owner approval.

Use a concession menu that targets move-in friction

Prefer: admin fee/app fee relief, move-in gifts, and time-boxed bundles (parking/storage/pet/WiFi).

Cap the total value and keep it time-bound.

Avoid concessions that quietly become ongoing monthly discounts.

Control lease terms to land expirations in stronger months

When possible, steer expirations into spring/summer.

Avoid creating a pile of December expirations that repeats the problem next year.

Defend renewals aggressively

Start earlier than normal during winter.

Use one-time credits, service perks, or small upgrades before cutting rent.

Make the “product” worth the rent

Photos, unit readiness, showing cadence, and small improvements that increase conversion.

If you need to spend money, spend it on speed and quality—not permanent rent cuts.

Guardrail language to use with owners:

“Contract rent is the asset. We can buy leasing speed with one-time move-in help, but we don’t permanently discount without a deliberate decision.”

Bottom line

Winter leasing is where rent rolls go to die—quietly. If the owner is heading toward a sale or refi window, the job is to keep the building’s income story intact. That usually means: avoid permanent rent cuts, use temporary tools, and be intentional about lease terms.

Want a second set of eyes?

If you’re advising an owner ahead of a sale or refinance, we can help you pressure-test the rent-roll strategy, concession menu, and renewal approach for the next 60–180 days. We can do that alongside the owner’s existing property manager—no need to switch management.

If it’s helpful, send us the rent roll and a short note on the timing and goals, and we’ll suggest a clean, underwriting-friendly plan.